Velosurance: Deluxe Insurance for Your Electric Bike

Electric bikes can be a significant investment and now there is electric bike specific insurance being offered by Velosurance Electric Bicycle Insurance.

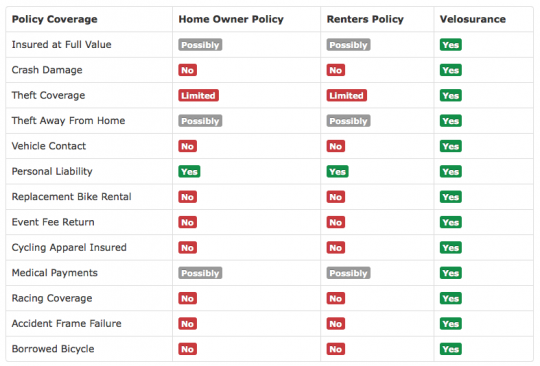

In fact, Velosurance offers many coverage options that traditional home owner or renter insurance policies don’t offer.

Velosurance offers the availability of a multi-risk, stand-alone bicycle insurance policy allowing cyclists to insure their bikes for theft, physical loss, damage, and liability.

Here is some information on e-bike specific insurance from Velosurance CEO, Dave Williams.

“There are over 15 million bicycles sold each year in the U.S., of which 4 million bicycles are of higher value and sold through specialty bicycle shops. Electric-assist bicycles are readily available at bicycle retail shops and the popularity of electric-assist bicycles is becoming a booming segment of the bicycle industry,” said Dave Williams, CEO and co-founder of Velosurance. “A good quality entry-level e-bike costs upwards of $1,000 and an average value of $3,000, with high-end e-bicycles costing as much as $12,000. Until Velosurance, cyclists had very limited options to protect their bicycles with adequate insurance coverage.”

Each policy is customized by the client and can include coverage protection on the e-bike for damage caused by theft, crash, collision, fire, attempted theft, vandalism or hitting another object. In addition, coverage of spare parts, cycle apparel, and rental reimbursement are included at no additional cost.

Optional coverage includes: Liability coverage to cover the rider in case of injuries or property damage caused by the insured cyclist; Medical Payments to cover medical costs of the policyholder associated with a cycling accident; and Vehicle Contact Protection for medical costs associated with accidents caused by an automobile. Additionally, Roadside Assistance is available, providing the cyclist a service vehicle ride of up to 35 miles.

Here is a chart that compares what Velosurance Electric Bicycle Insurance offers when compared to home owner or renter insurance policies.

Williams added, “In most cases, homeowner or renter’s insurance will not cover e-bikes for theft, damage, or liability because the bike has a motor and auto insurance companies will not offer e-bike insurance because e-bikes are not required to be registered, and e-bike riders do not need to be licensed. This is where Velosurance steps in with a stand-alone e-bike insurance policy that insures e-bikes with power assist up to 750 watts, and covers just about anything that can happen.”

To enhance their e-bike policy service, Velosurance partnered with local bicycle shops nationwide to provide repair or replacement services to Velosurance policy holders. According to Williams, “No matter where our client is riding, there will be a Velosurance Trusted Partner bicycle shop nearby”.

E-bike policies start at $100 per year and offer a variety of coverage levels and deductible options. Bicycle insurance quote can be requested at velosurance.com or by phone at 888-663-9948.

Velosurance provides bicycle insurance policies in the following states: Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kentucky, Louisiana, Massachusetts, Maryland, Michigan, Minnesota, Missouri, North Carolina, New Hampshire, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, and Wisconsin.

Velosurance Electric Bicycle Insurance policies are underwritten by Markel American Insurance Company (NYSE:MKL)

P.S. Don’t forget to join the Electric Bike Report community for updates from the electric bike world, plus ebike riding and maintenance tips!

Reader Interactions

Trackbacks

-

-

[…] Velosurance offers electric bike insurance that covers much more than home owner or renter insurance policies cover. […]

[…] Velosurance is providing insurance for electric bikes. ”Each policy is customized by the client and can include coverage protection on the e-bike for damage caused by theft, crash, collision, fire, attempted theft, vandalism or hitting another object. In addition, coverage of spare parts, cycle apparel, and rental reimbursement are included at no additional cost.” […]